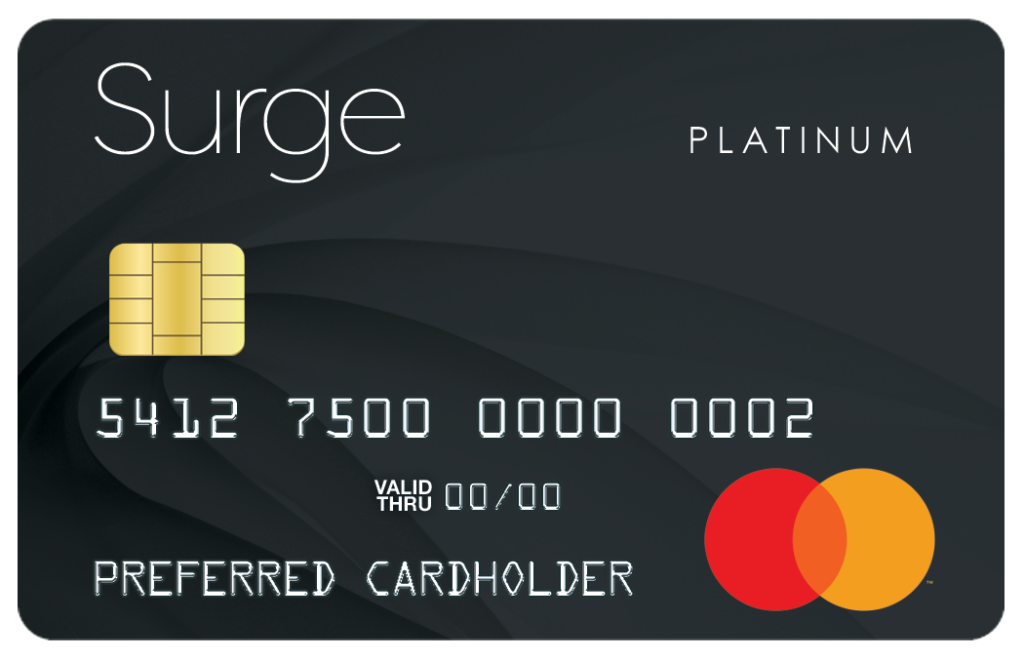

Learn how to apply for the Surge Secured Mastercard

Discover the process of acquiring the Surge Secured Mastercard ® Credit Card. The perfect choice for individuals seeking fresh starts.

Understanding the Surge Secured Mastercard ® Credit Card

If you are looking for a credit card that can help you start fresh or establish a positive credit history, the Surge Secured Mastercard ® Credit Card is worth considering. Discover why this credit card is ideal for those seeking this type of service and learn how to obtain it with a step-by-step guide below.

The Surge Secured Mastercard ® Credit Card offers quality service to its holders without requiring a positive credit history. This enables you to rebuild and organize your financial life. Additionally, your Surge Secured Mastercard ® Credit Card transactions will be reported to all three major US credit bureaus.

With the Surge Secured Mastercard ® Credit Card, cardholders can start with a healthy credit limit ranging from $300 to $1,000. By paying your credit card bills on time, you can become eligible to increase your limit.

As a cardholder, you will have access to a free monthly online credit score report. This allows you to understand the impact of your actions on your credit history.

How does the Surge Secured Mastercard ® Credit Card work?

Like many credit cards, the Surge Secured Mastercard ® Credit Card charges various fees for different purposes. Below, we will explain each fee in detail along with their respective values.

The Surge Secured Mastercard ® Credit Card charges an annual fee ranging from $75 to $99 for the first year of opening your account. After the first year, the annual fee will be fixed at $99.

A monthly maintenance fee of either $0 or $10 is applicable. During the first year of opening an account, this fee is waived.

If you miss a payment, a late fee of $40 will be imposed.

The APR rate for the Surge Secured Mastercard ® Credit Card ranges from 24.99% to 29.99%.

If you use your Surge Secured Mastercard ® Credit Card for foreign transactions while abroad, a 3% fee will be charged.

Who is eligible for the Surge Secured Mastercard ® Credit Card?

To apply for the Surge Secured Mastercard ® Credit Card, you must be a US citizen with a valid Social Security number and of legal age in the United States. A healthy credit history is not required as this card accepts prospective customers with poor credit history. It is also important to have a valid address, as it will be requested during the application process.

How to apply for the Surge Secured Mastercard ® Credit Card?

The Surge Secured Mastercard ® Credit Card offers several application methods: online, by mail, or by phone. To apply by phone, call 1-866-513-4598 and provide the required information. If you prefer to apply online, you will need to fill out a form with information such as your name, contact telephone number, valid address, and bank account details, among others. An active US Social Security number is also required.

Surge Secured Mastercard ® Credit Card vs. Credit One Bank American Express ® Credit Card

These two cards have different proposals. If you do not have a strong credit history to apply for the Credit One Bank American Express ® Credit Card, you can use the Surge Secured Mastercard ® Credit Card to improve your credit score.

Surge Secured Mastercard ® Credit Card benefits:

- No credit history check

- Multiple ways to apply

- Reports to major credit agencies

Credit One Bank American Express ® Credit Card benefits:

- Rewards program

- Easy application process

- Life insurance

How to apply for the Credit One Bank American Express ® Credit Card?

We have a separate article dedicated to providing more information about the Credit One Bank American Express ® Credit Card and a step-by-step guide on how to obtain it. Access it now through the button below and save time!