How to apply for SupaSmart Loans?

Keeping Your Children Safe on Social Media

Discover Everything You Need to Know About the Application Process

If you’re in need of a long-term personal loan, SupaSmart can assist you by connecting you with a diverse network of partner lenders. Unlike other companies that directly provide credit, SupaSmart operates as a platform that links customers to lenders within its system.

How does SupaSmart’s algorithm work? When you submit the application form, which includes details about the desired loan amount and repayment time, the software scans the lenders in the network to find options that match your preferences. This process occurs in just a few seconds, allowing you to quickly receive a proposal to apply directly to the loan lender.

One of the notable advantages of SupaSmart Loans is that their services are free of charge. You don’t have to pay anything for the convenience of searching for loans through their platform. Furthermore, you are under no obligation to accept the loan terms and can decline any offers.

It’s important to note that while SupaSmart Loans provides a connection to lenders, they cannot guarantee loan approval. The decision ultimately depends on the individual’s creditworthiness and financial standing.

Who Can Apply for a SupaSmart Loan?

To register on the SupaSmart Loans website, you only need to meet one condition: being 18 years of age or older. There are no other restrictions on requesting the brand’s services. However, it’s worth mentioning that the approval or denial of a personal loan is subject to the terms and conditions of the partner lender. Each lender has specific criteria, and SupaSmart’s algorithm verifies if your information aligns with those criteria.

In summary, anyone aged 18 or older can register on the platform. However, depending on factors such as credit history, income potential, and desired loan amount, SupaSmart’s algorithm may not always find a perfect match.

How Does the Application Process Work at SupaSmart Loans?

The application process for a personal loan with SupaSmart Loans is entirely online. South African citizens can fill out the application form directly on the platform.

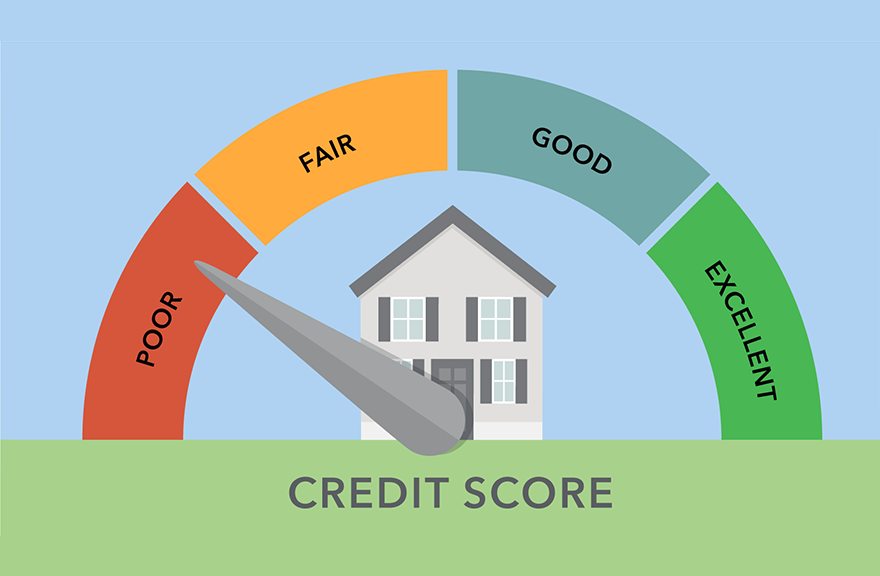

Prior to completing the application form, you have the option to obtain a credit report through SupaSmart’s partnership with MyFincheck, a company that provides credit reports. This allows you to check your available credit score.

When filling out the application form, you’ll need to provide the following details:

- Full name

- Cell phone number

- Email address

- Gross monthly income

- City

- South African identification number

- Loan amount

During the application process, you can also request the inclusion of life insurance and funeral coverage. However, selecting these additional services is not mandatory.

After submitting all the necessary information, SupaSmart’s system rapidly scans its internal database to provide a response. It’s crucial to ensure the accuracy of the provided data to avoid being directed to a lender who may deny the loan after conducting a credit check.

Throughout the application process, it’s important to understand that the loan terms and conditions, as well as any fees or procedures in case of non-payment, are determined by the lender. SupaSmart Loans simply facilitates the connection between borrowers and lenders.

Looking for an Alternative Lender?

If you’re interested in exploring other lending options, Sunshine Payday Loans is another credit company that offers fast and easy personal loans. Although the loan amounts offered are lower, with a limit of R4,000, they can be deposited into your account on the same day as your application.