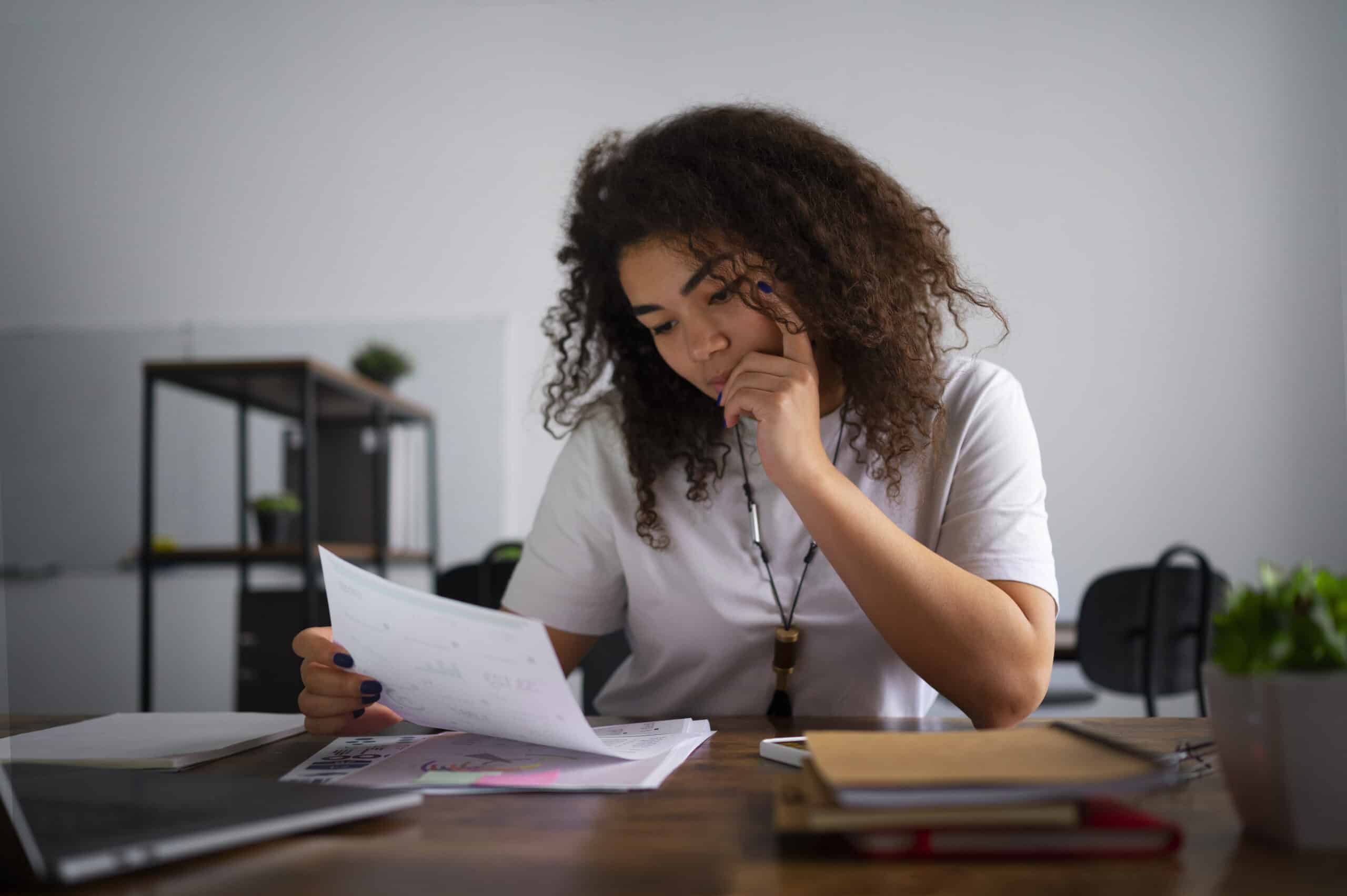

Learn how to apply for the Amazon Prime Rewards Visa Signature Card

To maximize your cashback earnings on Amazon purchases, it's essential to gain knowledge on the card application process.

The Amazon Prime Rewards Visa Signature Card: A Closer Look

The Amazon Prime Rewards Visa Signature Card offers several benefits to its users. It builds upon the features of its predecessor, the Amazon Rewards Visa Signature Card. One of the standout features of the new card is the unlimited 5% rewards rate on purchases made at Whole Foods and Amazon.com.

For current Amazon Prime members, the Amazon Prime Rewards Visa Signature Card is worth considering. Along with a greater rewards rate, cardholders also enjoy practical purchasing and travel protections. And let’s not forget the bragging rights that come with the shiny, metal card. If you frequently shop at Whole Foods or Amazon.com, this could be one of the best cash-back cards and the ideal credit card for Amazon purchases.

As a co-branded credit card, the Prime Rewards Visa Signature Card offers many advantages. It offers a fair cash-back percentage and allows easy redemption of rewards for Amazon purchases or statement credits. Additionally, it provides excellent consumer protection. When used correctly, this card can be a valuable addition to your wallet.

Who Can Apply?

To be eligible for the Amazon Prime Rewards Visa Signature Card, you must be 18 years of age or older. Additionally, the card is only available to Amazon Prime members. Therefore, you need to meet both of these requirements. It’s important to note that the card is intended for people with good credit, and a minimum credit score of 690 is required.

How to Apply

To apply for the Amazon Prime Rewards Visa Signature Card, you can complete the application process primarily online through the Amazon website. You’ll need to sign in to your Amazon account, as having an Amazon Prime membership is a prerequisite.

Most of your information has likely already been provided through previous subscriptions and orders. However, you may be asked to complete or verify certain details. After submitting your application, you’ll need to wait for approval, as this is a card intended for individuals with high credit scores. You can check the status of your application on the Amazon and Chase websites within a few days.

Is It Worth It?

The Amazon Prime Rewards Visa Signature Card is considered one of the best credit cards for online shopping due to its high reward rates on Amazon purchases and Visa Signature benefits. If you spend approximately $2,800 or more at Amazon and Whole Foods, this card can provide a healthy return on your investment. By using the card wisely, you can quickly recoup the cost of your Amazon Prime membership while enjoying other significant benefits, such as extensive travel and purchase protections.

If you fall into the categories of individuals who can make the most of this card, rest assured that its bonuses are among the best available.

Amazon Prime Rewards Visa Signature Card vs Amazon Business Prime American Express Card

While both the Amazon Prime Rewards Visa Signature Card and the Amazon Business Prime American Express Card offer similar perks, there are key differences. The Amazon Prime Rewards Visa Signature Card is tailored towards individuals who want to maximize their cashback earnings. On the other hand, the Amazon Business Prime American Express Card is designed for businesses, providing cashback bonuses and control over employee cards.

If you have a company or want to share the card’s benefits with others, the Amazon Business Prime American Express Card may be a better fit. However, if you’re an individual looking to earn cashback primarily for personal use, the Amazon Prime Rewards Visa Signature Card is the way to go.

Benefits of the Amazon Prime Rewards Visa Signature Card

- Receive an Amazon gift card immediately upon approval.

- 5% back at Amazon.com and Whole Foods Market with a qualifying Prime membership.

- 2% back at eateries, gas stations, and pharmacies.

- 1% back on all other purchases.

- No minimum prize balance needed for redemption.

Benefits of the Amazon Business Prime American Express Card

- No foreign transaction fees.

- Free employee cards with purchase restrictions available.

- Choose between 5% back or 90-day terms on eligible purchases at Amazon and Whole Foods.

How to Apply for the Amazon Business Prime American Express Card

If you’re interested in applying for the Amazon Business Prime American Express Card, you can find detailed instructions in our dedicated article on how to apply.