Meet the Best Credit Card for Your Need

The impact of social media on the mental health of teenagers. The effects of social media on the mental wellbeing of adolescents.

Discover the Perfect Credit Card for Your Financial Needs

Credit cards have become an indispensable tool for managing finances and making everyday purchases. However, with the multitude of credit card options available in the market, finding the one that suits your needs can be a daunting task. To make this process easier, it’s important to understand your spending habits, financial goals, and lifestyle requirements. In this comprehensive guide, we will walk you through the key factors to consider and help you find the best credit card for your needs.

Assessing Your Spending Habits

Before diving into the sea of credit card options, it’s crucial to take a closer look at your spending habits. Are you a frequent traveler, a shopaholic, or someone who prefers to dine out often? Different credit cards come with varying rewards and benefits tailored to specific spending categories.

For the Travel Enthusiast

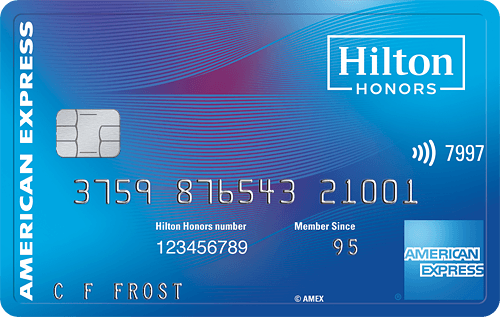

If you find yourself jet-setting frequently, a travel rewards credit card is worth considering. These cards often offer perks such as airline miles, hotel discounts, and access to airport lounges. Some even provide travel insurance coverage, protecting you against unforeseen travel mishaps.

For the Shopping Master

If you enjoy shopping and making purchases, a cashback credit card might be your best match. Cashback cards offer a percentage of your spending back as cash rewards, helping you save money on everyday purchases.

For Dining and Entertainment

For those who love dining out and attending events, credit cards that offer dining and entertainment rewards can be a great fit. These cards often provide discounts at restaurants, movie theaters, and other entertainment venues.

Understanding Rewards and Benefits

Credit card rewards and benefits can significantly enhance your financial experience. It’s important to understand the different types of rewards and benefits offered:

- Cashback Rewards: Cashback credit cards provide a percentage of your spending back as cash rewards. This can be a straightforward way to save money on your purchases.

- Travel Rewards: Travel credit cards offer rewards like airline miles, hotel points, and other travel-related perks. These rewards can be valuable for frequent travelers.

- Points Rewards: Points can be earned for various types of spending and can often be redeemed for a variety of rewards, including merchandise, gift cards, and travel expenses.

Examining Fees and Interest Rates

While rewards and benefits are attractive, it’s essential to consider the fees and interest rates associated with a credit card. Some common fees to look out for include:

- Annual Fee: Some credit cards charge an annual fee for the privilege of using the card. However, many cards also offer no-annual-fee options, so weigh the benefits against the cost before deciding.

- Late Payment Fees: Missing a payment deadline can result in late payment fees, which can add up over time. It’s crucial to pay your credit card bill on time to avoid these charges.

- Foreign Transaction Fees: If you’re a frequent traveler, watch out for foreign transaction fees. These fees apply when you make purchases in a foreign currency or outside your home country.

Interest rates, often referred to as APR, can significantly impact your overall credit card cost if you carry a balance from month to month. Cards with lower APRs are ideal if you anticipate carrying a balance, while those who pay off their balance in full each month might prioritize rewards and benefits over APR.

Building and Improving Credit

Your credit score plays a crucial role in determining the credit cards you qualify for and the interest rates you receive. If you’re just starting to build credit or working to improve a less-than-stellar credit history, there are credit card options designed for these situations:

- Secured Credit Cards: These cards require a security deposit, which often becomes your credit limit. They are an excellent option for building credit or recovering from past credit issues.

- Student Credit Cards: Geared toward students, these cards often have lower credit requirements and may offer rewards that cater to student lifestyles.

Navigating Rewards Redemption

Understanding how to redeem your credit card rewards is equally important. Some cards offer straightforward redemption options, while others have more complex reward systems. Common redemption methods include:

- Statement Credits

- Travel Redemption

- Gift Cards and Merchandise

The Power of Responsible Credit Card Use

While credit cards can provide convenience, rewards, and financial flexibility, responsible use is paramount. Follow these tips to make the most of your credit card:

- Pay on Time: Always pay your credit card bill on time to avoid late payment fees and maintain a good credit history.

- Monitor Your Spending: Keep track of your credit card transactions and set a budget to ensure you’re not overspending.

- Minimize Balances: If possible, pay your credit card balance in full each month to avoid accruing interest charges.

- Regularly Review Your Card: Stay informed about any changes to your credit card terms, fees, or rewards program.

In conclusion, choosing the best credit card for your needs involves a careful consideration of your spending habits, rewards preferences, fees, and interest rates. By evaluating these factors and understanding the potential benefits and pitfalls of credit card usage, you can select a card that aligns with your financial goals and enhances your overall financial well-being. Remember that responsible credit card use is key to building and maintaining a strong credit history, which can open doors to better financial opportunities in the future.