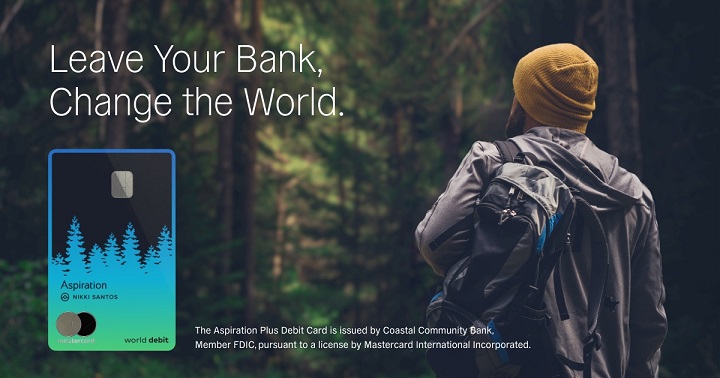

Aspiration Plus account full review

Earn up to 3.00% APY and save the planet, with the Aspiration Plus account that also provides up to 10% cash back for debit card purchases.

Discover the Benefits of the Aspiration Plus Account

If you’re looking for an efficient way to manage your money, gain additional benefits, and contribute to environmental causes, the Aspiration Plus account is the perfect solution for you.

Aspiration is a nonbank financial institution that offers the Spend and Save account, which combines checking and savings features.

The Aspiration Plus account is the option that offers the most benefits, although it does come with a monthly fee. However, this fee can be reduced if you choose to pay it annually.

With the Aspiration Plus account, you’ll have the ability to easily track your spending and its impact through a user-friendly app. Applying for the account is simple and can be done online in just a few minutes.

Now, let’s take a closer look at the benefits provided by the Aspiration Plus account:

- Earn 3% APY on your savings each month that you have $500 in qualifying debit card transactions.

- Receive 10% cash back on Conscience Coalition purchases.

- Get paid up to 2 days early.

- It only requires a minimum deposit of $10 to open.

- Have the option to plant a tree with every card swipe.

- Receive reimbursement for one out-of-network ATM fee per month.

- Enjoy fee-free withdrawals at a network of over 55,000 ATMs.

- Purchase Assurance provides coverage for items that are damaged or stolen within 90 days.

- Receive $600 in phone insurance when you pay your monthly phone bill with your Aspiration debit card.

Note: Although Aspiration is not a bank and CMAs are different from traditional bank accounts, customer deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. Aspiration partners with FDIC-insured banks to hold customer deposits.

Contribute to Environmental Causes with Every Card Swipe

One of the unique features of the Aspiration Plus account is the option to plant a tree every time you use your card.

In line with its commitment to environmental consciousness, the Aspiration Plus account also helps offset the negative climate impact of driving a car.

Furthermore, the account provides personal impact scores to help you make purchases that align with your values.

Advantages and Disadvantages of the Aspiration Plus Account

To help you make an informed decision about whether the Aspiration Plus account is right for you, let’s explore some pros and cons:

Advantages:

- Excellent APY on savings.

- Environmentally friendly.

- Cash back for spending with socially responsible companies.

- 10% of Aspiration’s customer fees are donated to charity.

Disadvantages:

- No option to deposit cash.

- Unclear fees for using out-of-network ATMs.

- Usage limits on debit cards internationally.

- The highest interest rate requires meeting certain requirements and paying a fee.

Requirements to Open the Account

To apply for the Aspiration Plus account, you need to be a US Citizen or permanent resident who is at least 18 years old. Additionally, you’ll need a Social Security Number and a checking or savings account.

The minimum deposit required to open an Aspiration Plus account is $10.

How to Apply for an Aspiration Plus Account

By becoming an Aspiration Plus account holder, you’ll be contributing to charitable causes, as Aspiration donates 10% of its profits to charity.

If you want to join this network of positive impact, follow these steps to apply for your Aspiration Plus account:

1. Click the green button below to visit the Aspiration website.

2. Explore and learn more about the eco-friendly Aspiration Plus account.

3. Complete the online application form.

4. Submit your application for review.

Don’t miss out on the benefits of the Aspiration Plus account. Take action today and make a difference with your finances!